What is the Price Reduction Clause?

GSA Schedule | Resources and Insight | 4 Min Read

Just like with commercial transactions, pricing is an important part of your GSA Schedule contract. Government agencies often prefer to purchase from GSA Schedules because they know they are getting their products and services at the best value and prices. This means that GSA contractors have to follow specific pricing rules and requirements, like reporting your Commercial Sales Practices.

If you are subject to Commercial Sales Practices, you will need to follow the Price Reduction Clause throughout the life of your contract. The Price Reduction Clause is one of the most crucial aspects to maintaining compliance with your GSA Schedule. This is what you need to know:

What is the Price Reduction Clause?

The Price Reduction Clause ensures a fixed relationship between the discounting practices offered by a contractor to GSA, and the discounts offered by the same contractor to its “Basis of Award customer.” The Basis of Award customer represents the customer that is used as the representative benchmark.

Before you are awarded a GSA Schedule, you will need to agree to a customer, or category of customers, which will be your Basis of Award (BOA). This is determined in your GSA MAS offer when you are completing your Commercial Sales Practices form (CSP-1).

Your BOA is typically the customer, or category of customers, who receive your best combined discounts/concessions. Your BOA customer is often the same as your Most Favored Customer (MFC), which also must be determined when completing the CSP-1 document. However, the two could be different, so you want to make sure you properly identify both categories of customers.

Your Commercial Sales Practices will establish the discount relationship between your BOA and the government. If the discount relationship changes in any way, the Price Reductions Clause (GSAR 552.238-81) is triggered.

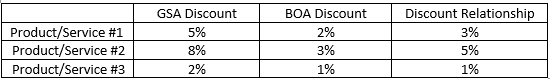

In the instance below, your discount relationship ranges from 1%-5%, and you have agreed that the government will always pay 1%-5% less than your BOA:

If you decide to lower your prices for your BOA, you must maintain that discount delta and lower your prices on your GSA Schedule to avoid violating the Price Reduction Clause. The Price Reduction Clause can be triggered at any point during the life of your GSA Schedule. However, there are some exceptions we’ll cover in distinguishing between standard and non-standard discounts.

Disclosing Discounts On Your Commercial Sales Practices

Your BOA discounts are disclosed on the Commercial Sales Practice form (CSP-1). Establishing and maintaining Commercial Sales Practices for your GSA Schedule can be complex. When preparing your Commercial Sales Practices for your GSA Schedule, the objective is to disclose all discounts and concessions currently offered to commercial customers. These practices may be based on myriad factors, below are some examples:

- Discounts exclusive to certain customer categories such as educational institutions, nonprofits, state and local governments, or national/corporate accounts

- Discounts on large quantities or volume purchases

- Discounts for favorable payment terms

- Shipping terms

- Concessions such as rebates or extended warranties

Standard Discounts

When developing your standard Commercial Sales Practices, you should focus on what discounts have been offered during the time period established (usually your last closed fiscal year). If these discounts should fall under one of the categories above, they are standard discounts. If you find a discount that was offered for a reason not listed above, it is likely a non-standard discount.

Non-Standard Discounts

Non-standard discounts are offered under very specific circumstances. Some examples may include selling products that have been discontinued, donating your products/services, mitigating a customer service dispute, etc.

It is important to distinguish between standard and non-standard discounts because non-standard discounts will not trigger the Price Reductions Clause so long as the discount was properly disclosed.

Other Price Reduction Clause Exceptions

In addition to non-standard discounts, there are a few more instances where you can deviate from the disclosed discounts and not trigger the Price Reduction Clause:

- A commercial sale that exceeds the maximum order limit for the Special Item Number (SIN).

- Additional discounts offered to the federal government.

- Additional discounts offered to an eligible ordering activity (per OGP 4800.2I) that is not part of the the federal government, but did purchase off of your GSA Schedule.

- If your contract participates in the Transactional Data Reporting (TDR) pilot program and doesn’t have to disclose Commercial Sales Practices.

What Do You Do if Your Prices Have Changed?

In the event your prices have changed and result in a disruption to the discount relationship, you have up to 15 calendar days to notify your GSA Contracting Officer. This is imperative—if your Contracting Officer is not notified and the disruption is identified at a later date, then the Price Reductions Clause will be triggered, and your GSA sales will be audited accordingly to determine if an overpayment exists. Overpayments must be returned to the ordering activity, with interest, and you may be at risk of having your GSA schedule cancelled.

Maintaining Your GSA Schedule

Establishing and maintaining manageable Commercial Sales Practices is crucial to your success as a GSA contractor. Your GSA Schedule may be in place for up to 20 years and it is likely that your pricing and discounts will evolve during that time.

On top of Commercial Sales Practices and following the Price Reduction Clause, you have to stay on top of a lot of things to maintain compliance with your GSA Schedule. If you want to learn more about keeping up with your contract, you can check out this essential maintenance checklist.

If you have any questions about maintenance and compliance, your Commercial Sales Practices, or the Price Reduction Clause, one of our GSA Schedule experts would be happy to help you.

About Christina Kacem

Christina Kacem is a Lead Consultant at Winvale. She brings four years of GSA experience to the Winvale team that includes the acquisition and maintenance of both products and services schedules for large and small businesses. Christina is especially proficient in strategizing tactics for the atypical scenarios that all too frequent the current market. Prior to joining Winvale Christina worked as a trade funds manager for a fortune 500 company, customizing plans for retail partners in support of seasonal initiatives. In every professional position she has held Christina has always supported the training and development of new and existing team members.