Small Business Set-Aside Spending Through the GSA Schedules Program

Government Business Development | 6 Min Read

So far in 2024, the federal government has spent over $13,479,101,845 billion dollars on contracts with roughly 12,000 small businesses vendors under the General Services Administration (GSA) Multiple Award Schedule.

The federal government establishes formal goals to ensure small businesses get their fair share of work. When solicitations from the federal government are between $10,000 and $250,000, there is an automatic set-aside for small businesses. The federal government mandates these set-asides to achieve small business goals and give small businesses a fair chance to win government contracts. Set-asides are exclusively reserved for small businesses, which limits competition and increases the odds as defined in the Federal Acquisition Regulation (FAR). This article will discuss government contracting spending and how much of it flows through small business contractors.

Small Businesses Set Asides and their Spending Trends

The federal government has established several types of small business designations so set-aside programs more efficiently reach the desired business types. These business designations are associated with set-aside programs that help small businesses win at least 23% of all federal contracting dollars each year. To help provide a level playing field for small businesses, the government limits competition for certain contracts to small businesses. As mentioned above, those contracts are called small business set-asides, and they help small businesses compete for and win federal contracts.

The amount of money that is flowing from the federal government is monumental and increasing every year. So far in 2024, their small business has received almost 34% of all contract spending. That percentage translates to 3,390,044,883 in sales since January 1.

Small Disadvantaged Businesses (SDBs)

Small Disadvantaged Businesses are firms that are 51% or more owned and controlled by a socially and economically disadvantaged person and meet the SBA’s size standards. Additionally, the 8(a) Business Development Program further serves disadvantaged entities. The purpose of the 8(a) Business Development Program is to assist eligible small, disadvantaged business concerns owned and controlled by socially and economically disadvantaged individuals to compete with larger companies.

Through the 8(a) Program, businesses receive training and technical assistance which helps them strengthen their ability to compete effectively in the economy. Small Disadvantaged businesses received over a billion dollars of set-asides making almost 14% of all contract sales. The 8(a) Program added $2,042,263,182 of sales (5.45% of all sales) from 1,383 vendors to the small business set-aside program.

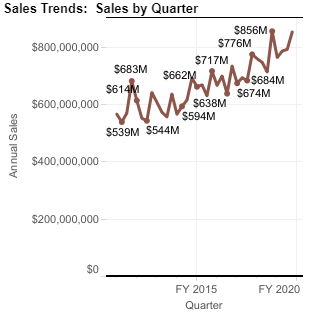

This graph below doesn't have the best scale up to FY2024 (if you've used SSQ+ you know the deal), but shows the gradual growth over the last several years.

HubZone Small Businesses

The HUBZone (Historically Underutilized Business Zone) program is designed to help small businesses that are in demographically specified areas. The government sets an annual goal of at least 3% of federal contract dollars to HUBZone-certified companies each year. Companies that operate in a HUBZone receive preferential consideration and a 10% price elevation preference in full and open contract competition. One of the smallest set-asides the HUBZone program has accounted for $1,313,562,012 million dollars or 3.5% of GSA contract sales through November 2024.

Women-Owned Small Businesses

Women-Owned Small businesses are part of another group that is eligible for contracting assistance programs. The government limits competition for certain contracts to businesses that participate in the Women-Owned Small Business (WOSB) federal contracting program. If your company is 51% controlled and owned by a woman and meets the requirements for a small business, then your company qualifies for these set asides.

Making up about 9.8% of GSA small business contract sales, Women-Owned Small Businesses have pulled $3,659,099,285 million dollars in sales from 3,381 vendors. The funding for this set-aside is roughly stable but has large opportunities for money flowing through.

Service-Disabled Veteran-Owned Small Businesses

Every year, the federal government awards a portion of contracting dollars specifically to businesses owned by veterans, called Service-Disabled Veteran-Owned small businesses. Also, small businesses owned by veterans may be eligible to purchase surplus property from the federal government. Service-Disabled Veteran-Owned Small Businesses received 7.6% of the funding in FY24 so far equaling about $2,858,945,712 of sales from 1,712 vendors. This set-aside program has been expanding every year.

The Different Types of Small Business Set-Asides

The federal government uses small business set-asides when products or services can be completed by at least two small businesses. To fulfill small business contracting goals, Contracting Officers often determine whether an acquisition can be completed through set-asides first before opening it up to other businesses. There are two types of set-asides for government contracts, competitive set-asides, and sole-source set-asides.

Competitive set-aside contracts are the most common type of set-aside and occur when at least two small businesses can perform the work or provide the products being purchased. With few exceptions, this happens automatically for all government contracts under $250,000.

Sole-source set-asides are non-competitive set-asides where there’s only one viable source to fulfill the contract. Sole source set-asides are not used very often. Both SBA’s regulations and the Federal Acquisition Regulation require you to consider SBA socio-economic programs first for set-aside and sole-source contracts worth $150,000 or more. There is no order of preference among the programs.

Getting Awards with Your GSA Schedule Contract

The federal government has established programs to help small businesses like yours succeed. If your company meets the qualifications as a small business, then you are in a great position to find the set-aside that is right for your company. Be sure to register your business with the System for Award Management (SAM) and explore the SBA’s contracting assistance programs. You can also use SAM to search for small business set-asides and other relevant contracting opportunities.

For additional questions about small business set-asides or if you would like to learn more about how you can position your company for government opportunities, reach out to a member of the Winvale team today.

-1.jpg)