Breaking Down the Multiple Award Schedule (MAS) Program

Government Business Development | 6 Min Read

The GSA Multiple Award Schedule (MAS) program has long been regarded as one of the most popular government contract vehicles, allowing commercial companies to sell their products and services to federal, state, and local government entities. With pre-negotiated pricing and pre-vetted contractors, the MAS program streamlines the procurement process making it much more efficient to buy and sell products and services.

As a current or prospective contractor, it’s important to understand the marketplace as a whole and what is trending. Now that Q4 of the government Fiscal Year has officially started, let’s take a look at the MAS Program from overall sales to specific industries and small business sales.

Overall GSA MAS Sales

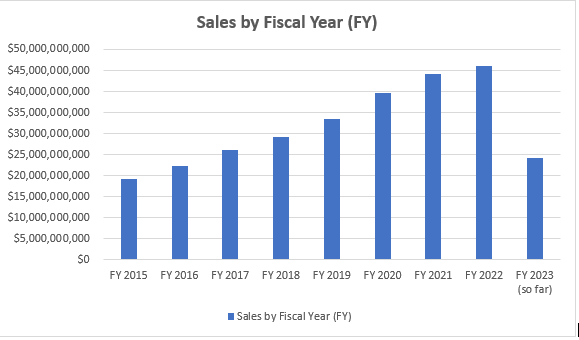

First, let’s take a bird’s eye view of sales through the Multiple Award Schedule (MAS) program. We used the Schedule Sales Query Plus (SSQ+) tool to calculate sales through the MAS program from Fiscal Year (FY) 2015 up to FY 2023 so far. It’s important to note that the federal government FY runs from October 1 through September 30, so we are entering the last quarter of 2023 soon.

As you can see, there is a steady incline of sales throughout the years, and an especially notable jump from 2019 to 2020. Since the pandemic was declared a national emergency, it heavily influenced government spending and budgets, and continues to increase as initiatives for cybersecurity, Information Technology (IT), small business participation, and supply chain remediation are carried out.

As the most popular government contract vehicle, it’s no surprise that MAS sales in FY 2022 crossed over 40 billion and it continues to rise, as FY 2023 sales are on track to beat last year’s numbers.

A Closer Look at GSA Schedule Contractors

Now, let’s take a look at contractors in the MAS program. Who are you competing with, who are you working with, who is in the same marketplace as you? All the numbers in this section are from FY 2022 to present.

As of June 2023, there are 14,851 vendors in the MAS program. Of that number, roughly 12,000 or 80% of them are small businesses. The majority of contractors are IT or Large Category F contractors, and the most populated Special Item Number (SIN) is 54151S (IT Professional Services) with 4,853 contractors.

Sales by GSA Large Category

The GSA MAS program is broken down into 12 Large Categories. This structure was created during the MAS consolidation, so contractors could sell products and services under one GSA Schedule instead of acquiring multiple Schedules for each of their offerings.

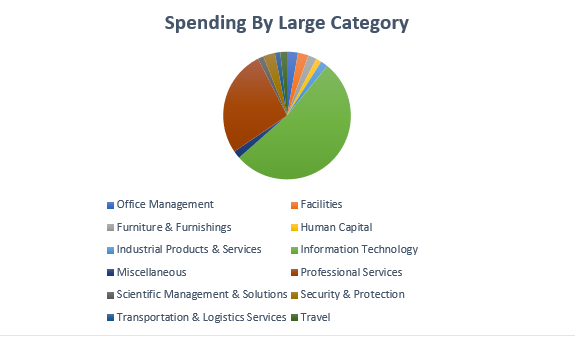

Below, we used the SSQ+ tool to help us determine the breakdown of sales by Large Category. It’s important as both a current or prospective contractor to have a better understanding of the market as a whole.

As you can imagine, certain Large Categories dominate the market. The IT category (Large Category F) in light green accounts for 53% of sales overall, and Professional Services (Large Category H) in brown comes in second with 27%. The remaining 10 categories are more evenly split.

However, if you do not sell products or services under the top 2 categories, there are still plenty of opportunities. Some offerings are more specialized than others, or it could mean you are getting into an untapped market with less competition and room to grow. On the other hand, if you do sell IT solutions or Professional Services, you know these categories are in high demand.

Top NAICS Codes

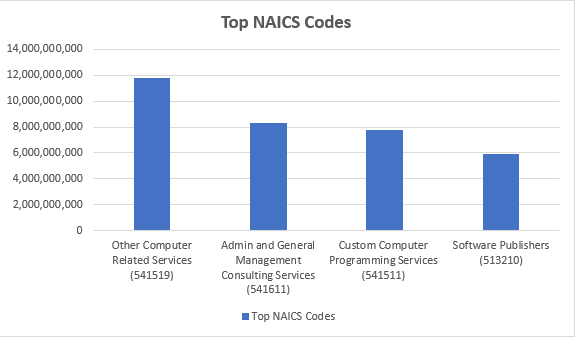

Now that we’ve covered the top Large Categories, let’s get more granular and talk about the top North American Industry Classification (NAICS) Codes from FY 2022 to present. NAICS Codes are a classification system used by the government to collect, analyze, and publish statistical data.

From a contractor perspective, they help you determine whether you are a small or large business, and help you find relevant government contracting opportunities. Understanding the top NAICS Codes in the GSA MAS program will help you gain a better perspective of which industries are the most active.

As you can see, the top two NAICS Codes come from the IT and Professional Services categories. Other Computer Related Services has a large jump on the other NAICS Codes with just shy of $12 billion in sales. As the name suggests, this NAICS Code covers computer related services except custom programming, systems integration design, and facilities management services.

The second highest, Admin and General Management Consulting Services, comprises of advice and assistance to businesses and other organizations on management issues, such as strategic and organizational planning, financial planning and budgeting, human resource policies, production scheduling, and control planning.

The remaining two NAICS Codes are part of the IT Large Category and relate to writing, modifying, testing, and supporting software to meet the needs of a particular customer, and producing and distributing computer software, and providing support services to software purchasers.

Small Business Sales

The federal government has a goal to increase both the number of small business contracting opportunities, but also the number of small business contractors overall. To keep this goal on track, the Small Business Administration (SBA) outlines goals for each small business set-aside, which are:

|

Small Business Set-aside |

Contracting Goal |

|

Women-Owned Small Business |

5% |

|

Small Disadvantaged Business |

12% |

|

Service Disabled Veteran Owned Small Business |

3% |

|

HUBZone |

3% |

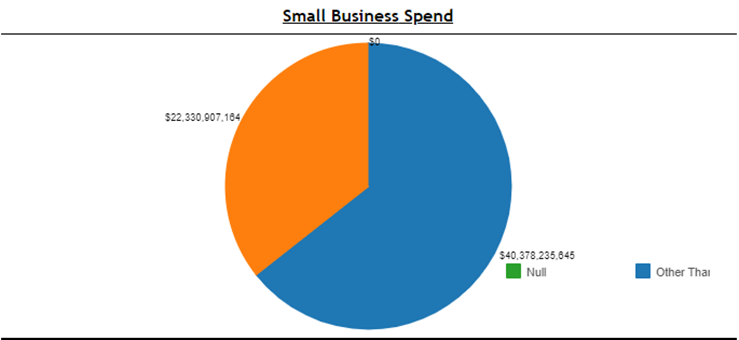

As we discussed earlier, small businesses make up roughly 80% of contractors, but how much do they make in MAS sales? Naturally, the larger companies tend to hold the bigger contracts, but small businesses are currently accounting for about 38% of the MAS sales.

Out of the 4 set-aside groups above, Small Disadvantaged Businesses have the most sales followed by Women-Owned, Service-Disabled Veteran-Owned, and HUBZone small businesses. For more on small business sales, check out our blog on Breaking Down Small Business Sales.

Performing Market Research on Your GSA Schedule

Now that Q4 is officially here and government agencies are about to go on a spending spree of sorts, it’s important to understand the marketplace and where it’s headed. Hopefully after this blog, you have a better idea of the federal marketplace and where you may fit in. This blog covered statistics as a whole, but did you know you can do more specialized research based off the products and services you offer? If you want to learn more about performing market research and researching your competitors, check out our blogs:

- Responding to RFIs: Tips and Tricks for Engaging in Market Research

- How Do I Find Government Customers?

- How to Research Your GSA Schedule Competitors

If you need help preparing your GSA Schedule for Q4 spending, for regular maintenance, or acquiring a GSA Schedule, we would be happy to help.

%20Program%20small.jpg)