A Comprehensive Guide to Small Business Subcontracting Plans

GSA Schedule | Resources and Insight | 9 Min Read

It’s no secret the federal government prioritizes small business participation in federal contracts. In Fiscal Year (FY) 2019, the federal government awarded $162.9 billion in contract dollars to small businesses. How does the government accomplish this?

The federal government requires Other Than Small Businesses (OTSB) to create a “practicable opportunity” for small businesses to participate in federal procurement. One of the ways to accomplish this is through small business subcontracting.

A lot of our clients ask if they need to make a small business subcontracting plan as GSA Schedule contractors. The answer depends on a few factors, so let’s cover what a small business contracting plan is, if you need one, and how to create the different types of subcontracting plans.

What is Subcontracting and What Does it Mean in Federal Contracting?

Small business subcontracting allows contractors to outsource a portion of their federal contracting dollars to small businesses. These small businesses do not work directly with the government, instead they work with the contractors to provide the federal government with products and services. Some government contracts require contractors to submit a small business subcontracting plan including GSA Schedule contracts.

What is a Small Business Subcontracting Plan?

The purpose of the small business subcontracting plan is to ensure Other Than Small Businesses (OTSBs), any business that is not considered a small business, are setting aside part of the federal money they receive to subcontract to small businesses. The plan is essentially a projection of how you want to allocate your contract requirements between your company and small businesses.

A small business subcontracting plan helps you determine and meet your subcontracting goals because you have to set-aside a dollar estimate for small businesses before you begin working on your contract.

There are two types of plans: commercial and individual. We will go into further detail on these below.

How Do I Know if I Need a Subcontracting Plan?

If you have a federal contract over the Simplified Acquisition Threshold (SAT) of $750,000 and you are not a small business (qualifications explained in further detail below), then you will need a subcontracting plan.

It’s important to note some contracts and task orders will have their own set of requirements, but most other contracts will follow the Federal Acquisition Regulation (FAR) which states:

“Any contractor receiving a contract with a value greater than the Simplified Acquisition Threshold must agree in the contract that small business…concerns will have the maximum practicable opportunity to participate in contract performance consistent with its efficient performance.”

In other words, the federal government wants to ensure you are subcontracting whenever you can.

How Does the Government Define a Small Business?

How do you know what constitutes a small business in the U.S.? The Small Business Administration (SBA) has created a list of qualifications you have to meet to be considered a small business in the eyes of the government. You must:

- Be organized for profit (non-profits will have to make a subcontracting plan).

- Have a place of business in the U.S.

- Operate primarily within the U.S. If you are not a U.S. company, you must have U.S. headquarters and make a significant contribution to the American economy through taxes or use of American products, materials, or labor.

- Meet the numerical size standards as defined by the SBA using the Size Standards Tool. This is defined based on NAICS Codes. It’s important to note different contracts may have different NAICS, so you may be considered small on one contract and other than small on another, so you will need to fill out a subcontracting plan for any contract that you are considered an OTSB.

The SBA has created several programs to help small businesses win federal procurement dollars. There are five subcategories of small businesses associated with federal contracting:

- Small Disadvantaged Business

- Women-Owned Small Business (WOSB)

- Veteran-Owned Small Business (VOSB)

- Service-Disabled Veteran-Owned Small Business (SDVOSB)

- HUBZone

What Are the Types of Subcontracting Plans?

If you have to submit a subcontracting plan for your GSA Schedule contract, there are two options: commercial and individual.

What is a Commercial Subcontracting Plan?

A commercial subcontracting plan is defined by the FAR as a plan that “covers the fiscal year and applies to the entire production of commercial items by either the entire company or a portion thereof (e.g., division, plant, or product line).”

What does this mean? Essentially, a commercial plan covers all federal contracts for that year. You don’t need to make a separate plan for each of your contracts if you have multiple. It’s also based on actual spend, so when you are planning out what you expect the value of your subcontracting to be, you’re going to base it off of what your spending was on subcontracting the previous year.

This plan covers most of your corporate expenses as well, not just the specific expenses within your contracting agreement. It’s renewed annually on October 30, and you can renegotiate your plan with new goals each year.

Commercial is the preferred plan for product manufacturers because this type of plan automatically includes indirect spending, including all of your corporate expenses (more detail on indirect vs. indirect spending below). It’s more difficult for product manufacturers to tie direct contract spending to subcontracting goals.

Constructing a Commercial Subcontracting Plan

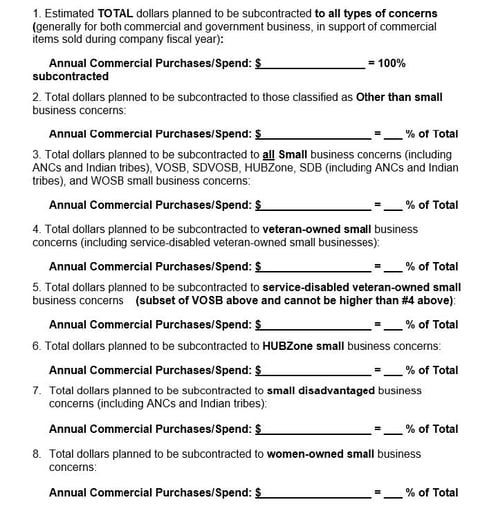

The first thing you need to do to create your commercial subcontracting plan is report what period the plan is going to cover (the fiscal year), and what your expected sales are for that year. Please note you will report your company-wide sales, not just your federal contract sales.

Next, you’ll need to estimate the total dollar amount that will be subcontracted for each category of small business, including WOSB, SDVOSB, VOSB, small disadvantaged, and HubZone. The SBA has recommended percentages (outlined in image number 3) they want you to try to hit in your plan for each subcategory. However, when you’re reporting your subcontracting numbers, one small business can count for multiple categories.

As mentioned before, this plan is based on actual spend, not what you’re hoping to subcontract from what you’re receiving from the government. This projection is made from how you spent your subcontracting dollars last year.

What is an Individual Subcontracting Plan?

According to the FAR, an individual subcontracting plan “covers the entire contract period (including option periods), applies to a specific contract, and has goals that are based on the offeror’s planned subcontracting in support of the specific contract.”

To sum it up, you will need an individual plan for each of your contracts. Unlike the commercial plan, the goals are based on what you expect to subcontract for the period of the entire contract, instead of your past performance from the previous fiscal year.

Constructing an Individual Subcontracting Plan

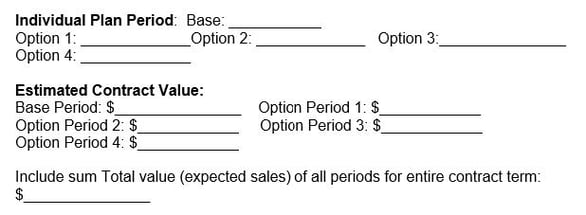

First, you need to estimate the value of each contract, including all option periods. As seen below, the plan is broken into base and option periods. Even if you don’t end up getting all these option periods, you will need to lay out what you predict to contract and what the value would be for the base and each option period.

Same as the commercial plan, you need to divide the contract award money based on the different categories of businesses you’ll be subcontracting to.

Same as the commercial plan, you need to divide the contract award money based on the different categories of businesses you’ll be subcontracting to.

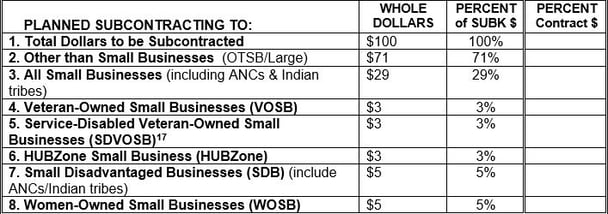

For example, if you have a $200 contract from the government (much smaller than any actual contract), you might expect $100 to be subcontracted. Of that $100, you might give $71 of that to OTSBs, and $29 to small businesses. In this plan, you’ll need to delineate how much you will allocate to each small business subcategory.

We provided an example below based on the SBA’s recommended percentages, but this is not what your contract will look like exactly. The percentages could be higher or lower based on what you and your Contracting Officer thinks your company can accomplish.

Once you figure out what you want to spend in your contract and what your spending goals are, you should know what is appropriate to report on your subcontracting plan. This is where direct and indirect subcontracting come in.

Direct vs Indirect Subcontracting

While commercial subcontracting plans don’t differentiate between direct or indirect subcontracting, it’s important for you to know the difference between the two, especially if you select an individual subcontracting plan.

Direct subcontracting is exactly what it sounds like--anything that is directly related to work performed under the contract. For example, if you’re contracted to provide plumbing services and you subcontract out to small businesses in Tampa and Atlanta, those will both count toward subcontracting goals as direct subcontracting.

Indirect subcontracting is anything that represents the costs of performing the business. For instance, you may need to hire an accounting firm to do your taxes. You can still count these toward your subcontracting goals, but they are considered non-controllable sources. You can include these costs in individual plans, but you need to state whether you intend to include them and how you will account for these costs. Remember these are automatically included in a commercial plan.

Reporting Your Subcontracting Plan

After you construct your plan, you will need to report its progress to the government on a fairly regular basis. For both commercial and individual plans you will need to fill out a Summary Subcontract Report (SSR) in the Electronic Subcontracting Reporting System (eSRS).

In the SSR, you will report your subcontracting numbers by business type whether it’s a large or small business (including small business categories), and compare these numbers to the goals laid out in your plan.

If you’re not hitting your goals, you’ll need to show the federal government you are making a “good faith effort.” You can make notes in the remarks section of the report to demonstrate the lengths of your effort. The SSR report is due once a year by October 30.

If you created an individual plan, you will need to submit an additional report in the eSRS aptly named the Individual Subcontracting Report (ISR). These are due twice a year on April 30 and October 30. Just like the SSR, you’ll need to report how much money went toward subcontracting and compare it to your goals. Unlike the SSR, this report is cumulative and will automatically fill in the totals from all your contracts if you have multiple.

Developing and Meeting Your Subcontracting Goals

Plans are essential to success, but they only work well if they’re executed properly. After you create your subcontracting plan, you’ll want to work out how you can effectively meet your goals.

There are several resources available to help you conduct outreach activity and find small businesses who might want to subcontract with you. Some resources include:

- Dynamic Business Search

- National Women’s Business Council

- Veteran Owned Business Directory

- Minority Business Development Agency

As we all know, deadlines always seem to sneak up on us, so make sure you designate someone to act as an administrator for your contracting and subcontracting goals. This person can put structures in place to ensure your company is trying its best to hit all its goals.

If you consistently miss your goals and cannot demonstrate to the government you are working in “good faith” to improve, you risk rejection or cancellation of your contract. You may also be responsible for the liquidated damages. So it’s important to stay on top of your goals and plan realistically.

Our consultants at Winvale are always here to help you with your GSA Schedule contract and subcontracting needs. If you have any further questions about subcontracting or want to learn more about how you can be a successful contractor, don’t hesitate to contact us.

For more information on small business subcontracting plans, check out our Lunch and Learn webinar.

.jpg)