How to Use SBA’s Size Standard Tool

Government Business Development | 5 Min Read

If you think you may qualify as a small business in the eyes of the government, there’s a fairly simple way to find out. The Small Business Administration (SBA) has the Size Standards Tool to give small businesses a better idea of how they may qualify as a small business. It’s beneficial for contractors to know if they are designated as a small business because it opens doors to assistance programs, tools, and certain small business set-asides. In this blog, I’ll cover what information is needed to utilize the SBA’s Size Standards tool and what you can do if you qualify as a small business.

Step 1: Defining Your Primary NAICS Code

North American Industry Classification System (NAICS) Codes are part of a classification system used by government agencies to collect, analyze, and publish statistical data on the North American business economy. The federal procurement sector uses the codes to classify specific industries. Simply, NAICS Codes are a reference number or point that is used to describe the core of a firm’s business. GSA utilizes these codes by matching up their Special Item Numbers (SINs) so there’s typically a correlating fit.

So, why are we discussing NAICS Codes? Well, the first step in using the Size Standards Tool is to make sure you have defined a primary NAICS Code. Size Standards are based off NAICS Codes and are important in determining your business size.

What is a NAICS Code Size Standard?

As mentioned above, NAICS Codes are used to decide whether a company qualifies as a small business concern for federal contracting purposes. It considers economic characteristics comprising the structure of an industry, including:

- Degree of competition

- Average firm size

- Start-up costs and entry barriers

- Distribution of firms by size

- Technological changes

- Competition from other industries

- Growth trends

- Historical activity within an industry

- Unique factors occurring in the industry that may distinguish small firms from other firms

- Objectives and impact on those programs of different size standard levels

Using this data, the SBA is able to set its size standards for businesses across all industries. You can find more information on how the SBA forms their size standards here.

It’s important to note that SBA regularly updates size standards, so if your business was not considered small in the past, that may have changed.

Step 2: Gather Revenue and Employee Information

For the use of the SBA’s Size Standards tool, you will need two pieces of information from your firm. The first is the average annual receipts or revenue for the last five years. For that information, you will need to take your total revenue for the last 5 years and divide that by 5.

The second piece of information you will need is the average number of employees for the last 24 months. The SBA counts all individuals employed on a full-time, part-time, or other basis. This includes employees obtained from a temporary employee agency, professional employee organization, or leasing concern.

Depending on your primary NAICS Code, the tool will ask for either your annual receipts/revenue or your number of employees, so it’s best to have both handy.

Step 3: Entering Information into the SBA Size Standards Tool

To get started on the size standards tool, you can find it on SBA’s website. It will take you to the page below.

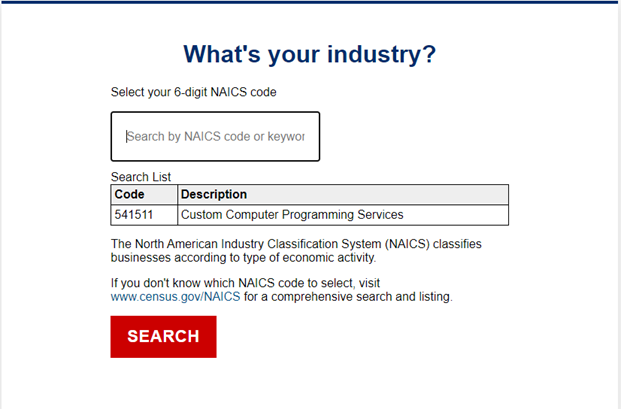

Once you have gotten to that page, select “Start” to get started. Once you have selected start you will need to input your 6-digit primary NAICS Code. Contractors will usually know ahead of time what their NAICS Code is, but if you’re unsure you can use this blog to help determine your NAICS Code. Once you have input your NAICS Code, it will automatically generate the NAICS Code and description in a drop-down seen below.

So, for example, if your primary NAICS Code is 541511 Custom Computer Programming Services, it will look like this:

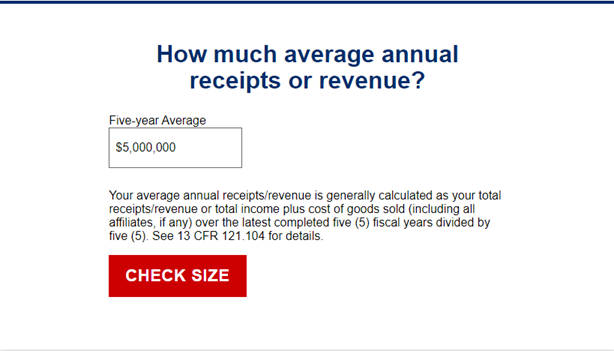

Once inputted, select search and go to the next page. On the next page, you will want to either your “Average annual receipts or revenue” or “number of employees” depending on what the page prompts you. For this example, the SBA wants to know average annual receipts or revenue.

So you would enter the number in the “Five-Year Average” box and select “Check Size.”

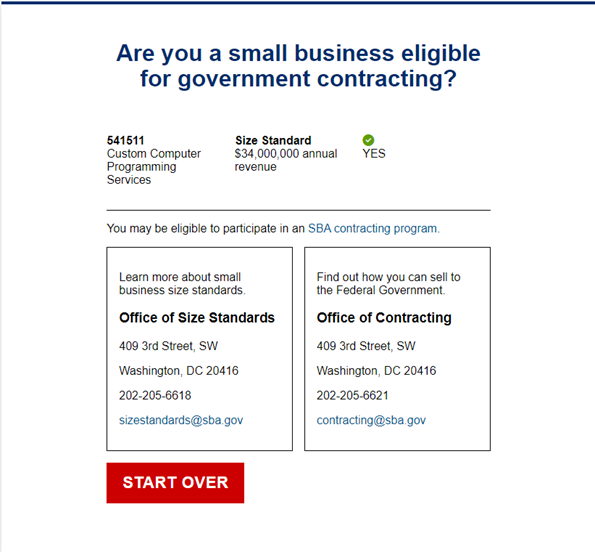

Once you have selected “Check Size” it will show if you may qualify as a small business under that NAICS Code. It will also give you additional information as to which office you should reach out to for more information on determining your size standard.

As you can see, the green check mark below has decided that with these numbers, our example is considered a small business.

You’ve Determined You’re a Small Business—Now What?

If your company is considered a small business, congratulations! This can be a great advantage in the federal market. Once you determine your business size, you should ensure you are declared on your SAM.gov registration record as small, and begin marketing your company as a small business. This is important because government agencies are looking for small businesses to meet their small business goals and prime contractors are looking for subcontractors to partner with.

As a small business, you will have access to several assistance programs and small business set-asides to help you better compete in the market. You can also qualify for additional socio-economic programs as a small business especially if you are women-owned, veteran-owned, live in a historically underutilized area, are economically disadvantaged etc.

Utilizing your small business designations to their full potential can benefit your business exponentially in the federal marketplace. If you’re unsure if you are utilizing your small business qualifications, or you are interested in getting a GSA Schedule to take advantage of your small business designation, we would be happy to help you.