NAICS Codes 101 in 2026

GSA Schedule | Resources and Insight | 4 Min Read

If you have a GSA Schedule or have worked with the federal government in any capacity, you have undoubtedly heard the term “NAICS Code” referenced before. But what exactly is a NAICS Code? And what is its relevance to GSA Schedules? We at Winvale get a lot of questions regarding NAICS Codes from our clients, so let’s break down the basics of NAICS Codes.

What Are NAICS Codes?

NAICS stands for North American Industry Classification System, established in 1997 by the Office of Management and Budget (OMB) to create a standard for statistical agencies in Mexico and Canada. The purpose of creating this specific classification system was to create a universal classification system used by government agencies to collect, analyze and publish statistical data on the United States business economy. The federal procurement sector uses the codes to classify industries.

To put it in the simplest terms possible, a NAICS Code is a reference number or point that is used to describe the core of a firm’s business. GSA determines which Special Item Numbers (SINs) match with which NAICS Codes by looking at the scopes of each and matching them as closely as possible.

If you are a GSA Schedule holder and don’t know your current NAICS Code or are wondering how you can view your current NAICS Code, all NAICS Codes are listed on the U.S. Census Bureau NAICS webpage.

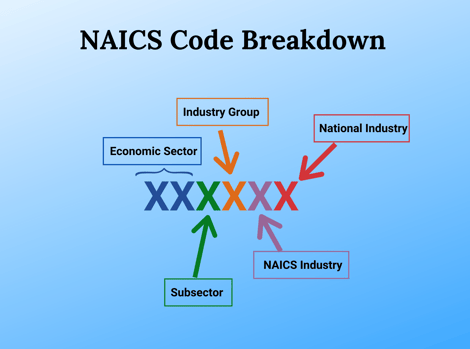

NAICS Digits: What Do they Mean?

A NAICS Code is a six-digit numeric code. The first two digits define the economic sector. The third, fourth, fifth and six digits designate the Subsector, Industry group, NAICS industry and National industry respectively (seen in the graphic below).

Why Are NAICS Codes Important?

NAICS Codes are important because they categorize your business into different industries that are then used for agencies to evaluate their procurement needs. But this isn't the only aspect of NAICS Codes. What is so useful about these codes is that you can find opportunities based on your specific NAICS Codes.

For example, if you sell IT equipment such as laptops and hardware, you'll want to be looking for opportunities on sites such as SAM.gov that are soliciting the actual equipment and not services, or software. Using your primary NAICS Code to search for upcoming opportunities will save you time and help you find relevant awards to go after.

Using NAICS Codes to Determine Size Standards

Another use for NAICS Codes is determining business size. The Small Business Administration (SBA) has developed size standards based off of NAICS Codes, and these are used to determine whether a firm qualifies as a Small Business or “Other than Small” business.

Size standards are determined in one of two ways: either by the number of employees a company has or by measuring the average annual “receipts” a company produces. Annual receipts refers to the gross revenue a company generates from a number of factors including revenues from sales, interests, rents, fees, and commissions among other things. Qualifying as a small business has several advantages, including increased marketing and federal business sales opportunities.

The NAICS Code System is Self-Assigning

One nice feature of the NAICS Code system is that it is a self-assigning system. This means a company can select a NAICS Code that best applies to the core of their business from their own perspective.

This also applies to those who are looking to get a GSA Schedule. Although NAICS are already pre-determined by this point, companies can request a NAICS Code change as long as it is relevant to the scope of their business and falls within the same category.

You can add additional NAICS Codes to your SAM.gov registration if you believe it aligns with your scope of business. There isn’t a limit on the number of NAICS Codes on in your SAM.gov registration, however you must use your primary NAICS Code to determine business size. The only instance in which a NAICS Code cannot be self-assigned is when it is dealt through OSHA (Occupational Safety and Health Administration), the EPA (Environmental Protection Agency), or the DEP (Department of Environmental Protection) which has to do with environmental factors more than anything else.

It’s important to note that while there are NAICS Codes listed that start with 44 and 45, these NAICS Codes are prohibited from the GSA Schedule. If your primary NAICS Code starts with this number and you have a GSA contract, you will need to change it.

NAICS Codes Align with Special Item Numbers (SINs)

When the Multiple Award Schedule (MAS) consolidation was released a few years ago, Special Item Numbers (SINs) and NAICS Codes were cross-walked so they are very similar to one another. Due to this change, there has been some long lasting confusion in between NAICS Codes and SINs, but they are separate classifiers. SINs are GSA specific, and relate to items being sold under the Multiple Award Schedule (MAS) Program. NAICS Codes are for all businesses, and not specific to GSA Schedule contractors.

While it may be confusing at first, the alignment does help with understanding which SINs to go after under a GSA Schedule because you can use your NAICS Codes to map to the correct SINs.

Do You Want to Learn More About NAICS Codes?

For more on the importance of NAICS Codes and additional information on the federal marketplace in general, check out our blogs on NAICS codes, including “Top NAICS Codes in FY 2025” and “Identify Your Best Opportunities with NAICS Codes.” Understanding how to use NAICS Codes to your advantage will help you identify more relevant opportunities for your company in 2026, and ultimately secure more government business.