How Do I Determine the Right NAICS Code for My Business?

GSA Schedule | Government Business Development | 5 Min Read

On the journey to obtain your GSA Schedule contract, you will encounter North American Industry Classification System (NAICS) Codes. NAICS Codes appear at all phases of GSA contract acquisition and throughout the life of your contract. As you register your SAM.gov account, you will have to select your NAICS Code and if you want to add new Special Item Numbers (SINs) to your contract, you will need to add the appropriate code. Government solicitations such as Requests for Proposals (RFPs) and Requests for Quotation (RFQs) all have NAICS Codes attached to them. Each time you come across one or have to select a NAICS Code, the question is “how do I determine the right NAICS code for my business?”

In this article, we will explain the structure of the NAICS Code, where to look for the full listing of NAICS Codes, the advantages of using NAICS Codes, and finally, we will discuss how to determine the right NAICS Code for your business.

What Are NAICS Codes?

In 1997, the Office of Management and Budget (OMB) established The North American Industry Classification System (NAICS) as the standard for federal statistical agencies in classifying business establishments for the collection, analysis, and publication of statistical data related to the U.S. business economy.

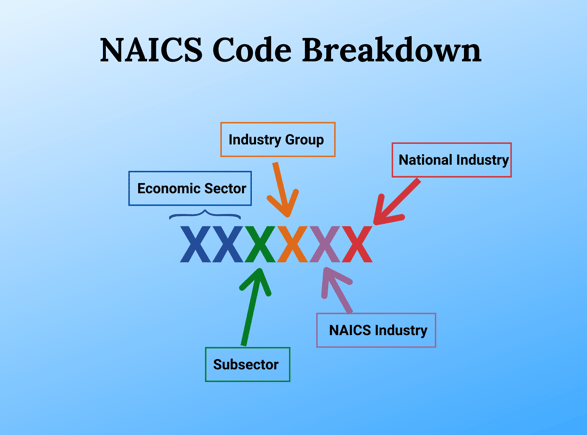

NAICS is a two-through-six-digit hierarchical classification code system, where each of the digits in the code is part of a series of progressively narrower categories. More digits in the code signify greater classification detail. The graphic below explains what each digit means.

The Advantages of Using NAICS Codes

NAICS codes offer many benefits to companies that want to obtain a GSA Multiple Award Schedule (MAS) contract or look for contracting benefits when working with the public sector. Each opportunity that is issued by a federal agency is assigned at least one NAICS Code. This designation allows these opportunities and contracts to be tracked for research and reportable data in the future. Often, solicitation descriptions or requests for proposals (RFPs) can be vague, so the NAICS designation can further help companies decipher whether they are a good fit for the opportunity.

Having a NAICS Code associated with your entity when you register on SAM.gov is foundational to acquiring a GSA Schedule because it represents the preponderance of your company’s work. Selecting the proper NAICS Codes means that the SINs you submit in your offer will be accepted by the GSA Contracting Officer.

NAICS Codes also help you determine whether you are a small business in the eyes of the government. Small business set asides and other programs offered by the Small Business Administration (SBA) require that you meet the size standards associated with your primary NAICS Code. The SBA developed size standards for each NAICS category. These are used to determine whether a firm qualifies as a small business or “Other than Small (OTSB)” business. Ensuring that you have the code that best fits your company means you can unlock major government spending to boost your company.

Where to Find a Full Listing of NAICS Codes

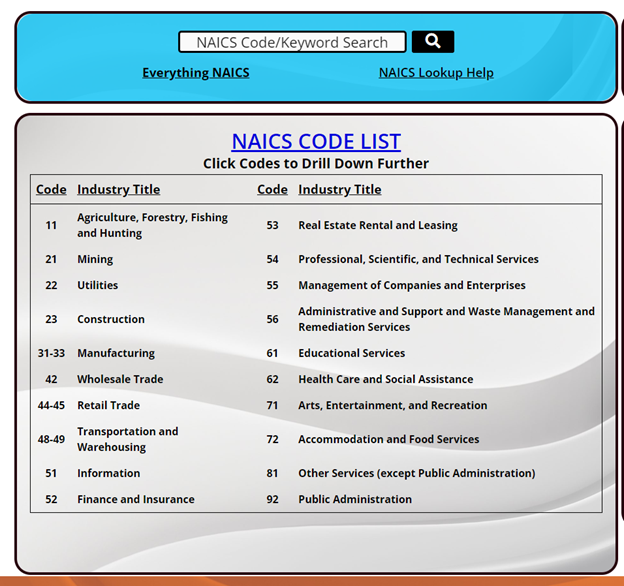

A consolidated list of NAICS Codes can be found on the official NAICS website. On this website, you can download and sort through the available listings and the SINs that fall under each NAICS Code. The Codes available under each of the twenty sectors.

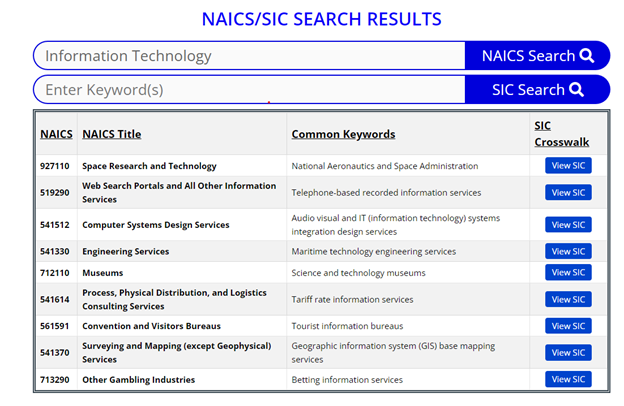

The website also has a search function where you can look up applicable codes using keywords. If your business focuses on “Information Technology” you can search this term and related NAICS Codes will appear. The breadth of listings and ensures that your company can find its space in the federal marketplace.

How to Determine the Right NACIS Code for Your Business

Now that you know the who, what, where, and why of NAICS Codes, let’s figure out how to find the best one for your company. NAICS was designed and is presented in such a way to allow companies to self-establish the codes they work under.

You can use the NAICS set of powerful search tools to find any NAICS Code quickly and easily. By entering a keyword that describes your kind of business, you will find a list of primary business activities containing that keyword and the corresponding NAICS Codes will appear. Choose the one that most closely corresponds to your primary business activity or refine your search to obtain other choices (example seen below from naics.com).

Rather than searching through a list of primary business activities, you may also browse the NAICS Codes and titles to find your code. You can select the category that applies to your business, and drill down through the more detailed levels until you find the appropriate 6-digit code.

Rather than searching through a list of primary business activities, you may also browse the NAICS Codes and titles to find your code. You can select the category that applies to your business, and drill down through the more detailed levels until you find the appropriate 6-digit code.

The Market Research function on the NAICS site is a valuable tool that every company should use before making serious decisions. NAICS can help with this aspect of your business with this powerful tool. Here you can see exactly how many companies you will be competing against, large and small. Additionally, you can see where companies with like NAICS Codes are competing, globally and locally. Using these tools will help you direct your efforts toward assigning the NAICS Codes that best fit your entity.

Choosing the right NAICS Code means that your company can search and apply for solicitations like RFPs and RFQs, all of which have NAICS associated with them. The opportunities extend far beyond the NAICS site. The SAM.gov contracting opportunities tool can also be sorted by NAICS Codes. Using this tool to cross reference for NAICS Code choice guarantees that you have knowledge of the opportunities in the public sector for your company to work toward.

Need Help with Your Primary NAICS Code? Don’t Go It Alone

NAICS Codes are a must-have when dealing with Contracting Officers and government agencies. Every GSA SIN has one or more NAICS Code(s) assigned to it. This means that to utilize the GSA MAS program, your company must self-select the appropriate NAICS Codes.

Choosing the best NAICS Codes for your company can help propel your business to new and profitable opportunities in the public sector. For more information on NAICS Codes and how they play an important role in your federal marketplace presence, check out our blogs “NAICS Codes 101 in 2022” and “NAICS Codes – What Do they Mean for Your Business?”

If you need additional help with NAICS Codes or with your GSA Schedule in general, contact Winvale today.