What is Considered a GSA Sale?

GSA Schedule | 6 Min Read

A GSA Multiple Award Schedule (MAS) contract is no doubt a great business opportunity—not only does it open doors to a huge pool of government agencies, but the ability to sell directly to the largest buyer of goods and services in the world at pre-negotiated rates and shorter lead times is not something you can find in the commercial market. However, it’s not without effort. If you are interested in becoming a GSA contractor, or if you have recently been awarded a contract, it’s important you are aware of the requirements it takes to maintain a GSA Schedule contract. One of the main requirements is identifying what a GSA sale is and reporting it regularly to GSA. Several clients have come to us wondering what constitutes a GSA sale, so we have created a blog with everything you need to know.

GSA Sales Reporting

One of the most important compliance points to be aware of when maintaining your GSA Schedule is sales reporting. GSA contractors are required to report their sales on either a monthly or quarterly basis, depending whether they use Commercial Sales Practices (CSP) or Transactional Data Reporting (TDR). When it’s time to report sales, contractors will need to access the FAS Sales Reporting Portal (SRP) to enter their data and pay the Industrial Funding Fee (IFF). We’ll go into further detail on the IFF below, but it’s an essential part of managing your contract, and since it’s a small percentage of GSA sales, you definitely want to make sure you know what counts as a GSA sale.

What is Considered a GSA Sale?

Generally speaking, any time a product or service is purchased directly off your GSA Schedule, it’s considered a GSA sale. Similarly, any time a contract item is sold to an authorized government user at contract prices and there is no evidence of another contract vehicle in place, the order is considered a GSA sale. Although the list of potential federal buyers (authorized government users) is incredibly expansive, it can be useful for GSA contractors to have a general idea of eligible entities who can purchase off GSA Schedules.

We understand that sometimes it’s not as simple as that or as easy to figure out on your end. The following list gives more examples of when a sale is considered a GSA sale:

- GSA contract number is stated on the purchase order or task order

- Ordering information and terms are the same as your GSA Schedule

- Pricing is at or below the GSA Schedule price

- Government buyer made contact with you through GSA Advantage! or GSA eBuy

- Products listed under the Order Level Materials (OLM) Special Item Number (SIN)

- There is no indication of another contract vehicle in place (as mentioned above)

- Product or service is on your GSA Schedule (as mentioned above)

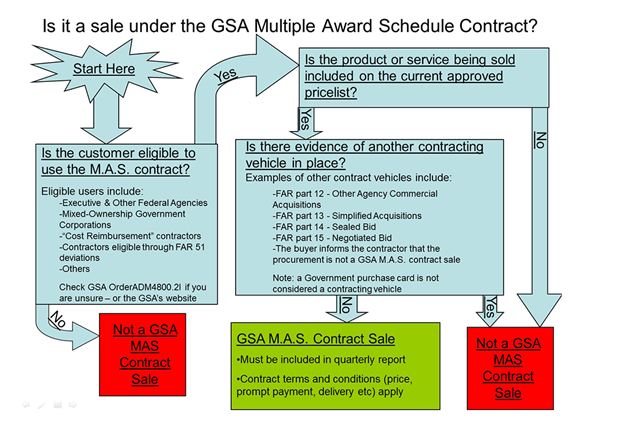

GSA has also published a graphic in the Vendor Support Center that can be useful in determining what is considered a GSA sale:

Agreements that Require GSA Sales Reporting

The following agreements would also be considered as GSA sales and would need to be reported accordingly.

Contractor Team Arrangements: Under a Contractor Team Arrangement (CTA), two or more GSA Schedule contractors work together to meet ordering activity needs. When reporting, each team member will be responsible for reporting their sales and submitting the appropriate portion of the Industrial Funding Fee (IFF) against their MAS contract.

GSA Resellers (Authorized Dealers): Some contractors partner with an authorized GSA reseller to sell products through a prime GSA Schedule. Contractors should work to carefully to coordinate with dealers in regard to invoicing and billing with this kind of relationship and should consider the reputational and financial risks associated. If you partner with a company on their prime contract, you are not responsible for reporting sales, but you must still accurately report all the information that goes along with your products, so they can determine whether or not it's a GSA sale.

What is Not Considered a GSA Sale?

When considering what is not a GSA sale, you should familiarize yourself with open market items. At its core, an open market item refers to an item for sale that is not listed or available on a government contract vehicle. This would include all non-contract items and services, such as Other Direct Costs (ODC) and travel expenses.

Open market items are often a point of confusion when it comes to sales reporting, as they are occasionally required to complete the full scope of an agency’s need. As a contractor, you may be able to provide those items, even if they are not approved under you GSA contract. In these cases, the ordering activity Contracting Officer (CO) must determine the prices for the open market items are “fair and reasonable.” Additionally, the items must be clearly labeled on the quote, order, and invoice as open market items.

It's important to distinguish open market items from the Order Level Materials (OLM) SIN. Open market items included in a GSA Schedule quote must be clearly labeled as open market. They are not considered a GSA sale if labeled as open market. Items quoted under the OLM SIN are considered a GSA sale, even though they are also add-ons that are not originally on your GSA Schedule.

In addition to open market items, work as a subcontractor (even if end user is a government agency) is almost never a sale under your contract and is therefore not reportable.

The Industrial Funding Fee (IFF) and Sales Reporting

The Industrial Funding Fee (IFF) is an integral part of GSA. Since GSA is one of the few self-funded agencies of the U.S. federal government, it doesn’t use American tax dollars to keep it running. Instead, it's powered by the IFF.

In addition to reporting GSA sales, GSA Schedule contractors are also required to pay their IFF Fee each quarter. As a GSA Multiple Award Schedule (MAS) contract holder, you will have 30 days from the close of a quarter to report your quarterly GSA sales and remit the IFF payment. For instance, sales reports and the accompanying IFF payment from the quarter January-March will be due on April 30.

The IFF is calculated as 0.75% of a contractor’s quarterly sales reporting totals. For instance, if a contractor is reporting $1,000 in quarterly sales, their corresponding IFF payment would be $7.50.

You should only report sales for products and services through your GSA Schedule contract. You can’t pay the IFF until your sales are reported, so make sure to have them in on time. As mentioned above, it’s also important that you correctly mark what is a GSA sale and what isn’t, so you don’t overpay or underpay your IFF.

Do You Have More Questions about Sales Reporting?

Maintaining compliance is an important part of becoming a successful GSA contractor. However, there’s a lot to keep up with and we don’t expect you to master it all in a few months or even a year. Often, contractors will turn to consultants to help them make sense of sales reporting, modifications, remitting the IFF among others. If you would like to learn more about GSA sales, the IFF payment, and other GSA topics, please check out our Winvale blog site which has a wide variety of articles covering a range of GSA topics. If you need help managing your GSA Schedule or just have questions about getting a GSA Schedule, please reach out to one of our consultants.