Commercial Sales Practices (CSP) vs. Transactional Data Reporting (TDR)

GSA Schedule | 6 Min Read

GSA Schedule contract compliance is not an easy task--there are so many requirements to abide by and keep up with, and frankly, it can be overwhelming. GSA Schedule contracts can be a great asset to your company, but they require time and dedication. One of the most important parts of maintaining contract compliance is sales reporting. This is the General Services Administration’s (GSA) way of tracking how your company is performing as a contractor, and collecting data on the solutions that are being acquired through the Multiple Award Schedule (MAS) Program.

Two methods that track sales and pricing are Commercial Sales Practices (CSP) and Transactional Data Reporting (TDR). Now that GSA is continuing their plan to expand TDR and they are cracking down on the GSA sales minimum requirement, it's important you know the differences between CDP and TDR and how to properly track your sales.

What Are Commercial Sales Practices?

Commercial Sales Practices (CSP) are used to determine which of your customers or customer class is offered the lowest price. If you opt into CSP, GSA requires the CSP-1 document to be submitted with your GSA MAS offer.

CSP-1 covers what customer classes you have sold to in the past 12 months and what discounts you have offered these customers. Once you’ve disclosed your discounting practices, you’ll determine your Most Favored Customer (MFC). GSA will then use that to negotiate a “fair and reasonable” discount based on what you’re offering to your MFC.

When you are filling out your Commercial Sales Practices, you’ll establish two types of customers:

- Most Favored Customer (MFC)

- Basis of Award (BOA)

It’s important to note that these two are generally the same for most GSA contractors. However, you still need to make the distinction because they are different for some contractors. For example, contractors who sell to Value Added Resellers (VAR) may list them as their best customer, but not the Basis of Award customer because what they are offering to VARs is not synonymous to GSA customers.

The Price Reduction Clause

If you are reporting Commercial Sales Practices, then you are subject to the Price Reduction Clause (PRC). The PRC was created to ensure GSA contractors maintain the discount relationship between their BOA customer and the government.

The PRC is triggered whenever you lower the price for your BOA throughout the entire life of your GSA Schedule contract. Once you lower the price for your BOA, you will have to lower your price for the government, maintaining the same discount delta.

For example, if you lower your BOA prices by 5%, you’ll need to discount 5% to the government as well. If you are using CSP, then we suggest you have an internal system in place so the right people are made aware of any price change and can make the necessary edits to your contract and stay within the guidelines of the PRC.

CSP Reporting Requirements

GSA Schedule contractors need to report their Commercial Sales Practices quarterly though the Federal Acquisition Service Sales Reporting Portal (FAS SRP). Quarterly means sales reports are due 30 days after each quarter ends, so reports will be due on January 30, April 30, July 30, and October 30.

For CSP, you report the total sales per Special Item Number (SIN). You don’t need to individually report on each particular contract order. Your Industrial Funding Fee (IFF) which is a fixed percentage of sales under your GSA Schedule, is due on the same day as your quarterly sales.

What is Transactional Data Reporting?

Transactional Data Reporting (TDR) is a way for GSA and its partner agencies to collect transactional-level data on solutions purchased through the MAS Program. TDR requires GSA Schedule contractors to electronically report the price the federal government paid for a product or service.

Transactional Data Reporting is not subject to the Price Reduction Clause and no CSP disclosure is required, meaning you do not need to report your MFC/BOA. Unlike Commercial Sales Practices, TDR is reported monthly instead of quarterly. There are also more factors involved in the reporting which we will cover below.

Currently, TDR is only open to contractors who sell under certain SINs, but GSA has expanded the eligibility in the last few months, and plans to expand it to several more SINs in Solicitation Refresh #27. Right now, TDR is a program you can opt into if you're eligible, but the draft of Refresh #27 notes that GSA will make TDR mandatory for all products SINs and cloud SINs. We anticipate GSA to make TDR mandatory for all SINs in the future, but for now, CSP is still relevant for certain contractors.

TDR Reporting Requirements

As mentioned earlier, if you opt into TDR, you’ll need to report your sales monthly through the FAS SRP. Your reports are due on the 30th day of the following month. For example, you report your February sales on March 30th, not on the 31st.

Your Industrial Funding Fee is still due quarterly by the 30th day of January, April, July, and October, but you can voluntarily pay it monthly.

Although you do not need to disclose your Commercial Sales Practices, this method of reporting is more substantial.

There are 12 items you must keep track of on a monthly basis:

- Contractor or Blanket Purchase Agreement (BPA) Number

- Delivery/Task Order Number/Procurement Instrument Identifier (PIID)

- Non Federal Entity, if applicable

- Description of Deliverable

- Manufacturer Name

- Manufacturer Part Number

- Unit Measure (each, hour, case, lot)

- Quantity of Items Sold

- Universal Product Code

- Price Paid Per Unit

- Total Price

- Special Item Number (SIN)

Recently, GSA added 4 more metrics that are currently optional, but may eventually become mandatory as GSA collects more information. They are:

- Order Date

- Ship Date

- Zip Code Shipped To

- Federal Customer

These changes make it possible to monitor pricing compliance, analyze data by location, access cycle times and contract compliance, and analyze data by treasury agency code. The main goal of these changes is to maximize TDR data accuracy. Right now, GSA is focusing on updating accuracy for products, but plans to tackle services in the near future.

Breaking Down the Differences Between CSP and TDR

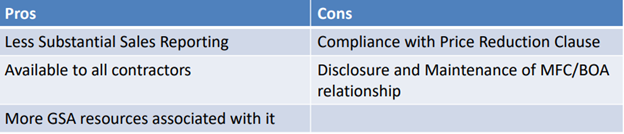

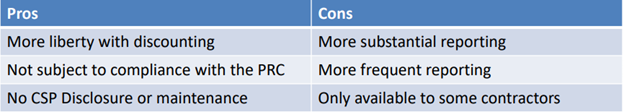

Both Commercial Sales Practices and Transactional Data Reporting have their benefits and disadvantages. While TDR might seem like the better choice because you don’t need to worry about disclosing your Most Favored Customer or abiding by the Price Reduction Clause, you have to report more frequently, and the process is more tedious. Currently, you may have a choice between the two so it really comes down to what works best for your business. We created two graphics below that might help you visualize the differences between the two methods.

Pros and Cons of Commercial Sales Practices

If you have standard discounting practices and don’t alter your prices a lot, CSP could be the best option for you. This option is also available to all GSA Schedule contractors, unlike TDR.

Pros and Cons of Transactional Data Reporting

If your company discounts or alters their prices often (and of course, if you're eligible to sell under TDR at the moment), TDR might be the way to go.

GSA Schedule Contractors Must Keep Up with Pricing Compliance

Whichever method you choose, you must be on top of reporting your sales. Pricing compliance is essential for maintaining your GSA Schedule contract, and with the new administration, it's important now more than ever. GSA will be cracking down on contractors who are not meeting the minimum sales, reporting their sales correctly, remitting their IFF, or following the Price Reduction Clause (if applicable).

As we've said before, keeping up with your GSA Schedule contract can be difficult and overwhelming. While GSA has resources that can help you make sense of it all, it can still be a very convoluted process especially if you do not have an organized system in place. If you have any questions about your GSA Schedule or need help maintaining your GSA Schedule contract, one of our consultants would be happy to help you.

.jpg)