Understanding NAICS Codes and their Structure

GSA Schedule | 5 Min Read

There are multiple facets to obtaining and understanding a GSA Schedule contract. One of the most important prerequisites to acquiring a GSA Schedule is having a set North American Industry Classification System (NAICS) Code, which corresponds to the core of your business. Your NAICS Code relates to the products and/or services you hope to be offering in the federal marketplace and serves as an important identifier for business size and relevant contracting opportunities. So, what are these numbers? How does their format play a role in your GSA contract? Throughout the course of this post, I’ll be going over what NAICS Codes are, their role in GSA, and their structure.

What Are NAICS Codes?

NAICS is an acronym which stands for North American Industry Classification System. This code is used by federal statistical agencies for classifying businesses for the purpose of collecting, analyzing, and publishing data related to businesses in the U.S. economy. This was created in 1997 by the Office of Management and Budget (OMB) to replace the former Standard Industrial Classification (SIC) system. NAICS Codes were designed to create a more connected system with statistical agencies in Canada and Mexico. Every code represents a designated area of work and specialization, ranging from furniture stores to food service contractors.

What Does the Structure of a NAICS Code Mean?

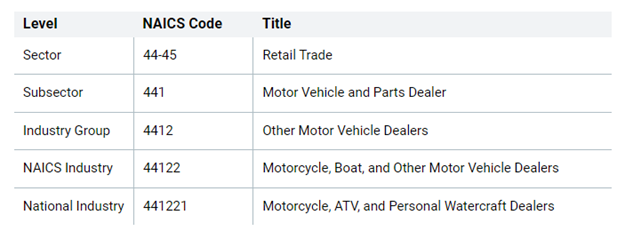

A NAICS Code is a six-digit numeric code which uses a hierarchical structure. A “hierarchy” is the relationship of one item to a particular category. The first two digits of the code represent the economic sector. The third, fourth, fifth, and sixth digits represent the Subsector, Industry group, NAICS Industry, and National Industry respectively.

As an example, below is a breakdown of NAICS Code 441221: Motorcycle, ATV, and Personal Watercraft Dealer.

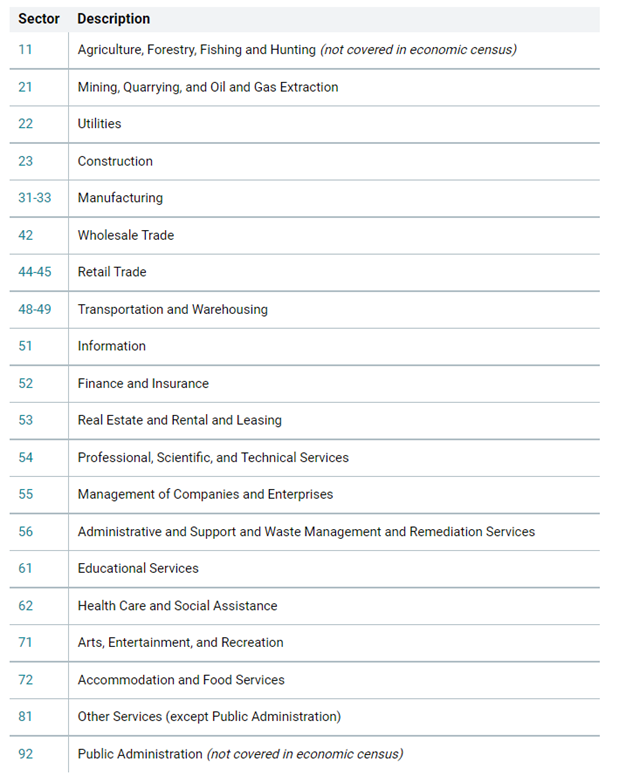

There are twenty sectors included in the NAICS. All of these sectors, except for 11 and 92, are part of the economic census:

The economic census does not typically include government-owned establishments, even when their primary scope would be in classified in industries covered by the economic census. With this in mind, census date for industries in many sectors might seem to be incomplete.

Certain industries dominated by government activity are excluded from the scope of NAICS Codes and the economic census. At the same time, exceptions have been made to include certain government activities in the census such as hospitals, government-owned liquor stores, university press publishers, and federal reserve banks.

The census does include the work of private contractors that may be conducting government functions on a contract. This includes highway contraction contractors, privately operated prisons, private firms contracting to provide services to government, and Government-Owned/Contractor-Operated (GOCO) plants.

NAICS Codes and GSA Schedules

In order to obtain a GSA Schedule, your company will need to have a designated NAICS Code(s) which corresponds to the products and/or services you are offering the government. These codes will inform what your applicable Special Item Numbers (SINs) would be. SINs are the categorization tool GSA uses to separate and categorize offerings in the federal marketplace. In the Multiple Award Schedule (MAS) organization, there are 12 Large Categories which are further broken down into Subcategories and then Special Item Numbers (SINs).

Under the Multiple Award Schedule (MAS) Consolidation, GSA has made it so NAICS Codes and SINs share a similar number. This change made the procurement process easier and more streamlined, however, it’s important to note that they are different classifiers and are used in different ways in the procurement process.

An example of how NAICS Codes and SINs appear can be seen below:

| SIN Title | SIN Number | NAICS Code |

| Document Conversion Services | 518210DC | 518210 |

| Copier Rental Solutions | 532420C | 532420 |

| Gloves | 339113G | 339113 |

One of the good things about NAICS Codes is that they are self-assigning, meaning you can select NAICS Codes which reflect the core of your business. You also have the option to select multiple NAICS Codes, and they can be added throughout the life of your SAM.gov registration.

The only instance where a NAICS Code cannot be self-assigned is when the offering deals with certain environmental factors. These would specially be handled through the OSHA (Occupational Safety and Health Administration), the EPA (Environmental Protection Agency), or the DEP (Department of Environmental Protection).

The Importance of Using NAICS Codes

NAICS Codes are an important identifier for your business, and GSA contractors should take advantage of them. First, NAICS Codes are used to determine the size of your business, so you can figure out whether you classify as a small business using the NAICS Size Standard tool. Small businesses have several specialized opportunities and set-aside contracts available to them, so it's important to know how your business classifies in the eyes of the government. NAICS Codes can also help you identify relevant contracting opportunities, so you can better narrow down the available contracts out there and go after the ones you are most qualified for.

How Do I Find My NAICS Code?

The full list of NAICS Codes can be found on the official NAICS website. Here, you can view the codes available under each of the twenty sectors, as shown in the picture above. The website also has a search function where you lookup applicable codes using keywords. For example, if your business focuses on “consulting,” you can enter this word into the search bar and related NAICS Codes will appear. The large range of listings and offerings ensures that every business can have a space in the federal market.

More Questions About NAICS Codes?

NAICS codes are an important part of searching for and understanding federal opportunities. They can have a direct impact on your presence in the government market. Check out some of our other blogs on NAICS codes, such as “NAICS Codes – What Do They Mean for your Business,” “Identify Your Best Opportunities With NAICS Codes,” and “5 FAQs About NAICS Codes.” If you have any more questions or need further help on understanding NAICS Codes, our team of consultants are available to you and your business.

.png)