Top Challenges in Maintaining Your GSA Schedule

GSA Schedule | 7 Min Read

Congratulations on being awarded a GSA Schedule contract—this achievement likely required countless hours of hard work navigating the requirements outlined in the Multiple Award Schedule (MAS) solicitation. However, the effort doesn’t stop here. As a contract holder, it's important to remain vigilant about several ongoing contract responsibilities.

Neglecting or failing to prioritize contract maintenance will lead to significant complications down the road. In this blog post, we will explore some of the most common challenges contractors face in the MAS program. By highlighting these challenges now, we hope to help you avoid potential headaches in the future and prepare you for what lies ahead.

Are You Prepared for GSA Schedule Contract Maintenance?

Before we begin, let’s talk about what areas you may need more support in. Ask yourself the following questions to ensure you are prepared to pursue opportunities and generate sales:

- Am I ready to actively seek out and pursue contract opportunities?

- Am I accurately reporting my sales?

- Am I prepared to complete FCP platform/SIP uploads?

- Is my SAM registration fully up to date, and can I identify potential scams related to SAM?

- Did I submit my contract modifications with the right documentation and support?

These questions are important for ensuring that your Schedule is fully compliant through the eyes of GSA. Now, let’s dive into common hurdles you may face and how to avoid them.

SAM.gov Registration and Avoiding Cyber Scams

Updating your SAM registration annually is mandatory for all contractors to remain active. One of the biggest hurdles in managing your registration is not only ensuring that your company is displaying all of the correct information such as ensuring that you’ve entered the correct business size, address, points of contact, and designations but also avoiding scams. These scammers have unfortunately recognized that they can pounce on the opportunity to “bait” contractors into scams upon re-registering. Here are some ways to recognize when you’re being scammed.

- Fake Phone Calls – did you receive a voicemail that reads on the lines of something like: "We’ve noticed that there are issues with your SAM.gov registration, and if you don’t make a payment of $500.00 today, your registration will be deactivated. Please respond to this call to speak with an agent.” If so, please don’t call them back. If you can, take note of the number and have it blocked. There is no guarantee that the caller won’t find other ways to reach out.

- Suspicious Texts and Email – did you receive an email or text that says something on the lines of: Your SAM registration has been renewed! You’ll need to pay $2,500.00 to “activate” it. These scammers will send you links that will lead to dangerous portals where it may ask you to fill out some of the most personal information such as your banking information, social security numbers, and your living address. They will also likely ask for a Taxpayer Identification Number (TIN) or Employer Identification Number (EIN). This sensitive business data could be used for scammers to file false tax returns or create fake businesses under your company’s name. You should always assume that outside email senders that don’t seem legitimate such as having .gov at the end of an email address will be scammers. If you receive these types of emails and texts, the easiest thing you can do is block them and delete the emails.

The important thing to remember here is SAM registration and renewal is always free and should be done through the SAM.gov site and nowhere else.

Generating GSA Sales and Meeting the Minimum Sales Requirement

In September 2023, the GSA revised a clause under I-FSS-639, granting Contracting Officers the authority to choose not to exercise the first option to extend a contract if the Contractor's sales do not meet specified criteria. Previously, the minimum sales requirement was $25,000 within the first two years of the contract, followed by at least $25,000 in sales every year thereafter.

The revised clause now requires contractors to achieve a minimum of $100,000 in sales during the first 60 months (5 years) of the contract, and $125,000 for each subsequent 60-month period.

While this change may seem intimidating, it's important to remember that you now have 5 years to meet the sales goal instead of 2, so you don’t have to worry if you don’t generate sales in the first year of your contract. Many contractors that didn’t generate enough sales throughout the first-period term of their contract have successfully obtained option period extensions by preparing and demonstrating a clear plan of action to the Contracting Officer. This plan could be in the form of making improvements to contract marketing efforts, actively pursuing bids, or hiring third-party consultants to manage GSA Schedules, among other strategies.

Reporting Your GSA Sales

Generating GSA sales? That’s great! Now comes the part where it is imperative to know when to report your sales. This needs to be general knowledge from the moment you receive your GSA Schedule. You are expected to report your sales every quarter (if you opt into Commercial Sales Practices) or monthly (if you opt into Transactional Data Reporting) in the FAS Sales Reporting Portal. This is crucial when Contractor Assessment Visits take place. During these assessments, an Industrial Operations Analyst (IOA) will analyze your sales practices and reporting history to ensure that your company is compliant with GSA’s terms and conditions.

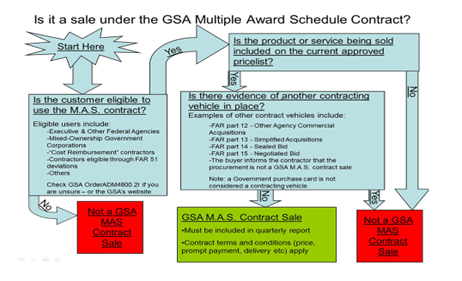

One hurdle that your company may face for sales reporting is ensuring that you’re distinguishing the differences between a GSA sale and a non-GSA sale. Any time you have a product/service being purchased directly off your GSA Schedule, it will be considered a GSA sale. Understand that sometimes it may not be as simple as that. To give you better guidance of what is and what is not a GSA sale, we’ve provided a list of examples. It is considered a GSA sale when:

- The GSA contract number is stated on the purchase order or task order

- Ordering information and terms are the same as your GSA Schedule

- Pricing is at or below the GSA Schedule price

- Government buyer made contact with you through GSA Advantage! or GSA eBuy

- Products listed under the Order Level Materials (OLM) Special Item Number (SIN)

- There is no indication of another contract vehicle in place (as mentioned above)

- Product or service is on your GSA Schedule (as mentioned above)

GSA has also published a graphic in the Vendor Support Center that can be useful in determining what is considered a GSA sale:

All contractors must remit the Industrial Funding Fee (IFF) on a quarterly basis, which accounts for 0.75% of GSA sales. If you are using the OLM SIN these items are still applicable to the IFF. If you add Open Market items to your task order, note that these are not considered GSA sales and should not be reported.

Submitting Applicable Support for Modifications

Keeping your GSA Schedule updated throughout the duration of your contracts requires submitting modifications as needed. The process can vary in speed depending on the type of modification you are submitting. For instance, if you submit a modification to add or delete any product or service, the time it takes to review and approve it can depend significantly on the Contracting Specialist assigned to your case.

One of the main hurdles you’ll likely run into when submitting a modification, particularly for adding products or services, is providing the right form of pricing support to justify the items being added. The preferred form of pricing support is invoices.

If you are unable to provide invoices, you can choose to conduct market research instead. If you can identify GSA contractors who have existing products or labor categories on contracts with higher pricing than what you are offering, this can help demonstrate to GSA that your prices are fair and reasonable. However, it's important to note that this type of support is prone to push back from Contracting Specialists. Recently, we have observed that Contracting Specialists are increasingly skeptical of this approach, as they prefer to see evidence of actual sales for the product or service you are seeking to add to your Schedule.

Adjusting to the New FCP Program

For many contractors, transitioning from the Schedule Input Program (SIP) to the new FAS Catalog Platform (FCP) presents a significant challenge, especially since SIP was already a common obstacle. SIP's desktop-based interface, with its multiple tabs and manual processes for submitting text file and price list catalog files, is time-consuming and cumbersome. Contractors must understand that uploading the finalized or updated GSA Price List to eLibrary occurs after submitting the modification.

While FCP is designed to offer an alternative way to publish text files to eLibrary, adapting to the new software can be overwhelming if you aren’t prepared or if your team is not familiar with the system. As GSA continues to implement FCP, contractors need to be ready to adjust to these changes.

Do You Need Help Maintaining Your GSA Schedule?

Keeping up with compliance metrics, regulations, and modifications can be overwhelming. Any unresolved issues may lead to penalties, fines, or even termination of your contract. If you have the time and resources to manage these compliance requirements and ensure your contract remains updated, you should be in good shape. However, if you find yourself lacking the time or capacity, we're here to take on these responsibilities for you. Our team is ready to assist with all the action items we've discussed and to address any questions or concerns you may have about your existing GSA Schedule.

.jpg)